Category: Portfolio

Three Eastlink Portfolio Companies Were Recognized in The 2025 Enterprise Tech 30 List for the Third Consecutive Year

We’re proud to see our 3 portfolio companies, Modal, MotherDuck, and Databricks earn top rankings on Wing Venture Capital’s Enterprise Tech 30 list for the 3rd year in a row! This recognition highlights the impact and innovation these companies are driving in enterprise technology.

Modal (#2 in Early Stage) – Modal is an IAS platform that allows users to deploy LLMs and run inferences in the cloud with only a few lines of code.

MotherDuck (#9 in Mid Stage) – Revolutionizing the data analytics landscape, MotherDuck combines the power of DuckDB with the cloud for lightning-fast, cost-efficient data processing.

Databricks (#1 in Giga Stage) – Databricks is the pioneer of the Data Intelligence Platform, empowering enterprises to unify, analyze, and leverage their data for transformative insights.

Congratulations to our portfolio companies for the three-peat! We’re proud to support their journeys and can’t wait to see what’s next.

Check out the full list here: Wing Venture Capital Enterprise Tech Top 30

Eastlink Capital’s Latest Investments and Milestones: Benchflow, Seraphic, Sensely AI, and Genmo

Eastlink Capital’s Fund Updates: Fueling Innovation Across AI

At Eastlink Capital, we remain committed to supporting transformative startups across AI Infrastructure and application. As we step further into 2025, we’re excited to share some of our latest investment and portfolio updates from 2024, highlighting key funding rounds and acquisitions that mark significant milestones for our partners.

Genmo – Series A Investment (2024)

Genmo is a text-to-video generation platform with an open-source state-of-the-art model that has high-fidelity motion and strong prompt adherence. In 2024, Eastlink Capital invested in Genmo’s Series A round, fueling its mission to push the boundaries of AI video generation.

BenchFlow – Pre-Seed Investment (December 2024)

BenchFlow is a cloud-native AI agent benchmarking and evaluation platform that simplifies AI model evaluation workflows and creates a marketplace for benchmark and evaluators. In December 2024, Eastlink Capital Co-led BenchFlow’s pre-seed round, backing its vision to redefine enterprise efficiency with next-gen automation tools.

Seraphic Security – Series A Investment (December 2024)

Seraphic is a complete enterprise browser security and governance solution designed to monitor and audit the browser by using a proxy or extension. In December 2024, Eastlink Capital doubled down on Seraphic’s Series A round, supporting the company’s rapid growth and strengthening the global enterprise browser security.

Sensely – Acquired by Mediktor (2024)

Sensely, a leader in AI-powered virtual health assistants, was acquired by Mediktor in 2024. Sensely’s technology, which enhances patient engagement through conversational AI, will now be integrated into Mediktor’s telehealth solutions, marking a strategic move in advancing AI-driven healthcare services.

As we continue to back pioneering startups, we’re thrilled to see our portfolio companies making strides in their respective industries. Stay tuned for more updates as we work alongside visionary entrepreneurs shaping the future of AI, cybersecurity, cloud automation, and digital health.

— Eastlink Capital Team

Doubling Down on Seraphic Security: Our Continued Bet on the Future of Browser Security

At Eastlink Capital, we believe in backing bold founders tackling critical cybersecurity challenges—and Seraphic Security is leading the charge in enterprise browser security. We’re thrilled to double down on our investment in Seraphic by participating in their $29M Series A round, led by GreatPoint Ventures, alongside CrowdStrike Falcon Fund, Planven, Cota Capital, and Storm Ventures.

In today’s SaaS-first, hybrid work environment, securing the enterprise browser is more important than ever. Seraphic Security is redefining how organizations protect their most critical access points, delivering cutting-edge security without compromising user experience. With this new funding, Seraphic is poised to scale operations in North America and EMEA while continuing to push the boundaries of innovation.

We couldn’t be more excited to support Seraphic’s visionary founders and world-class team as they build the future of enterprise browser security.

Modal Lab’s Series A and GA Launch

We are privileged to be a part of Modal’s Series A round to redefine the future of end-to-end cloud compute, providing serverless GPU to deploy AI models and run inference in the cloud with a few lines of code, without the complexities of setting up and maintaining your own cloud infra.

Modal Labs has launched its General Availability version. Everyone can try it out and run code in the cloud in a few minutes. Check it out today and you will be surprised how frictionless, scalable and cost-efficient it is!

Databricks’ Series I

Congrats to the Databricks team for the $500M Series I! We are so thrilled to double down our investment through its round, as an existing investor and faithful believer. We believe Databricks is incredibly positioned to be a generational company in the AI era, due to its robust tech/product, rapid pace of innovation, open-source root and vibrant ecosystem. Cannot wait to see what’s ahead for Databricks as it continues the journey of democratizing AI and Data through relentless innovation.

See more: press release on Forbes

MotherDuck Recognized on 2023 Enterprise Tech 30

Congrats to MotherDuck for being recognized on the 2023 Enterprise Tech 30 list. Quite an impressive lineup: https://axios.com/et30. MotherDuck was one of the five companies that was founded in the last 18 months.

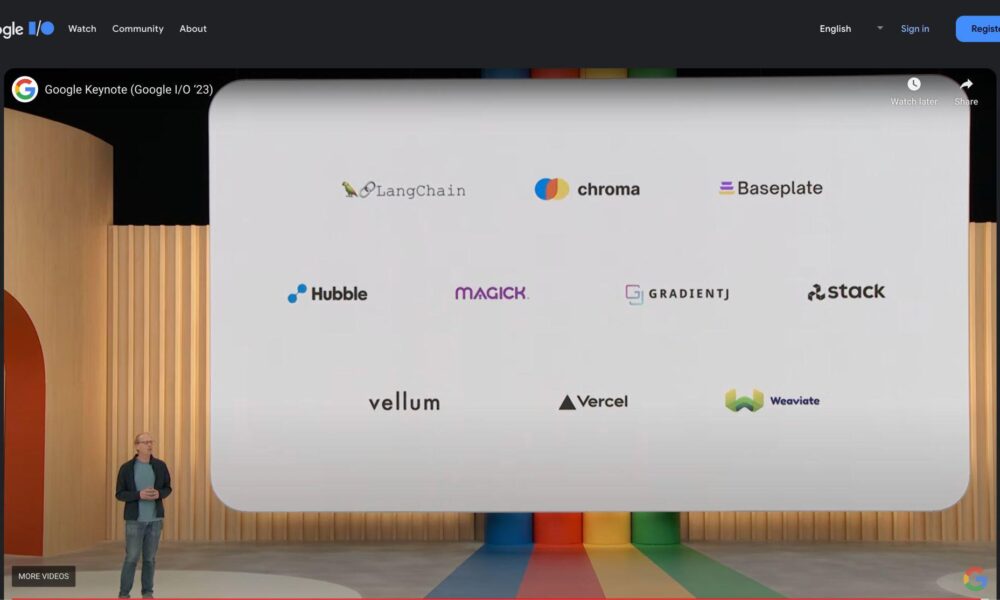

Vellum Featured in Google I/O

Congrats to Vellum for being featured in Google I/O 2023 keynote as a DevTool partner.

LLM developers, sign up at vellum.ai to try it out!

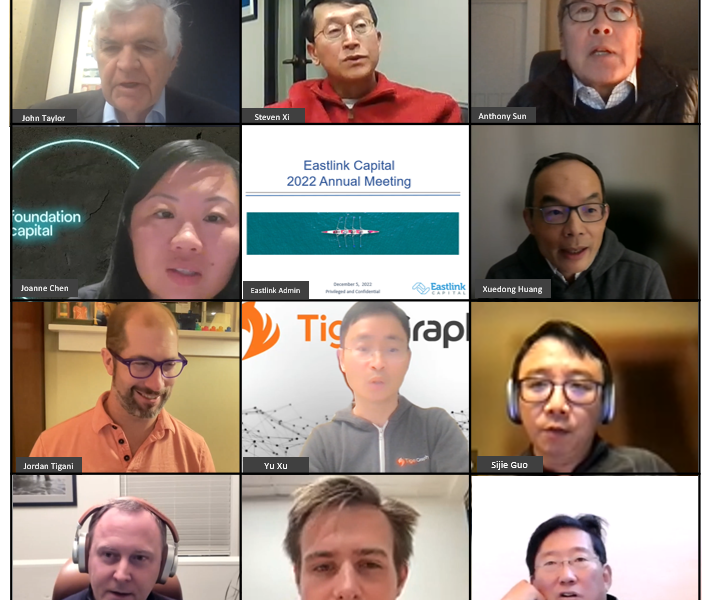

2022 Annual Meeting

We celebrated 2022 with our LPs, portfolio company executives, advisors/fellows/scouts and friends through a memorable and vibrant Annual Meeting and Dinner on Dec 5. It was a great honor to have Prof. John Taylor (Professor of Economics at Stanford, former Under Secretary of US Treasury for International Affairs) to share his perspectives on Fed and U.S Economy. During the fireside chat, Anthony Sun (ex-Managing Partner of Venrock, co-founder of GGV), Joanne Chen (GP at Foundation Capital), Xuedong Huang (Technical Fellow and CTO of Azure AI, Microsoft) and Timothy Chou (Instructor of Cloud Computing at Stanford and ex-President of Oracle On Demand) discussed the future of data and AI. Eastlink portfolio companies presented their amazing achievements. We are grateful for your support and being a part of your journey!

MotherDuck Raises $47.5M Funding to Bring DuckDB to the Cloud

We at Eastlink Capital are so thrilled to be part of MotherDuck’s $12.5M Seed led by Redpoint and $35M Series A led by Andreessen Horowitz. Other co-investors include Madrona, Amplify and Altimeter. MotherDuck is a hosted cloud offering of DuckDB, one of the hottest open-source database projects known for its lightweight, fast performance and ease to use, but runs on single node & on premise. Think of MotherDuck vs. DuckDB like how Microsoft Office 365 brings Excel / Word, etc. to the cloud and facilitates team collaboration and version control.

Why We Invested in Exotanium, a Next-Gen Cloud Resource Management Platform

by Steven Xi, Siyu Jia

Compute cost has always been a concern of cloud adoption and burden for the enterprises that consume a lot of cloud resources, such as those that conduct workload-heavy simulation, graphics rendering and especially High Performance Computing. Given the current tightening macro environment, CIOs place a heavier emphasis on ROI, in addition to performance and features.

Quite a few cloud cost optimization solutions have sprung up — many of them remain at the level of analytics and automation, while only a few have the technical in-depth down to low-level infrastructure. Exotanium, backed by patented technology from research at Cornell University, provides a layer of “cloud-prem” control designed to work across different cloud providers. Only a small number of computer scientists have the ability to manipulate the low level code of the operating system in their ways, which provides Exotanium with a high technical moat. Through live migration technology that is transparent to container runtime systems, containerized applications can be seamlessly migrated between virtual machines (VM) instances. By leveraging cloud spot market, which is cost-effective but subject to termination at any time, Exotanium’s X-Spot can generate up to 90% reduction in cloud compute cost while maintaining high reliability.

“The most magic thing about Exotanium is that it can predict which spot VM instance is going to run out and relocate the containers out of it,” said a customer. Exotanium’s unique AI/ML algorithm analyzes the correlation between various signals and actual termination events, and automatically switches between spot instances and on-demand instances without interruptions to applications. This enables the long-running stateful apps to use cheap machines, and therefore resolves the tradeoff between cost and reliability beautifully. Having a legacy app that nobody really knows how it works? Not a worry — no need to modify a single line of your code!

Exotanium’s additional benefits include better security and performance, enabled by its X-Container technology, which combines the strength of application containers and virtual machines. Used to be positioned as a security company at the inception, Exotanium utilizes X-Container architecture to improve inter-container security isolation. In a project partnered with DOE Idaho National Lab, Exotanium demonstrated not only more than 70% cost savings, but also faster performance than the native implementation.

In addition to the iconic X-Spot, Exotanium’s X-Stack automatically packs or unpack containers into different numbers of VMs depending on the workload, while X-Scale adjusts the machine size and power based on the current demand. Through dynamic scaling up and down without shutting down the applications, cloud-based software companies can minimize the redundant resource reserved for peak workloads. Exotanium is working on expanding its product line with further optimization on cost, reliability and security, as well as flexibility for hybrid cloud and multi-cloud strategy. We look forward to seeing more magic from Exotanium to fine-tune enterprise customers’ control over cloud computing.

Behind it all is exactly the right team to unleash the power of cloud back-end optimization. It has been a great pleasure working with CEO Prof. Hakim Weatherspoon and CTO Dr. Zhiming Shen. They are world-class researchers in cloud computing and operating systems, and then co-founders of the Cornell spinout to commercialize their R&D innovation. The academic root of Exotanium mirrors our portfolio company Databricks, a leading data and AI company which originated from UC Berkeley’s RISELabs. InsightFinder, another Eastlink’s portfolio company with origins in academia, was spun off from Prof. Helen Gu’s group at N.C. State University and leverages unsupervised machine learning to predict IT incidents hours ahead.

We are excited to be part of Exotanium’s Series A round of financing. Eastlink Capital’s core investment strategy is to back technical founders with unique products / technologies, and Exotanium fits well with this theme. We strongly believe Exotanium is well on its way to take sig