Author: Eastlink Capital

Eastlink Portfolio Update: Seraphic Security Acquired by CrowdStrike

We are pleased to share that Seraphic Security, a portfolio company of Eastlink Capital Fund II, has entered into a definitive agreement to be acquired by CrowdStrike (NASDAQ: CRWD), as announced on January 13, 2026.

We are grateful to have been part of the journey with founders Ilan Yeshua (CEO), Suresh Batchu (COO), Avihay Cohen, and the entire Seraphic team. Their execution in building a category-defining browser security platform has been impressive. While this was our first partnership with Ilan and Andy, it marks our second successful collaboration with Suresh, who was previously a co-founder and CTO at MobileIron, a Fund I portfolio company.

We congratulate the Seraphic team on this milestone and look forward to seeing their technology scale as part of CrowdStrike’s Falcon platform.

Read the full announcement from CrowdStrike here:

https://www.crowdstrike.com/press-releases/crowdstrike-to-acquire-seraphic/

Databricks’ AI Bet Pays Off as Valuation Tops $130B

The unified data and AI platform strengthens its position amid soaring enterprise demand for AI-native infrastructure

Databricks is reportedly in discussions to raise new capital at a valuation above $130 billion, marking a ~30% increase over its last financing round just two months ago. The potential raise underscores the company’s accelerating growth and its importance in the rapidly evolving AI economy.

Founded in 2013 and built on the research behind Apache Spark, Databricks has grown into one of the world’s most influential data and AI platforms. Its core mission—unifying data engineering, analytics, governance, and AI model development—has become foundational as enterprises race to adopt AI-driven workflows.

Enterprise AI demand pushes Databricks to new highs

The company has been aggressively expanding its AI offerings, including:

- Databricks AI/BI, enabling natural language querying of enterprise data

- DBRX, its open-source LLM designed for enterprise workloads

- AI agents and tools that automate knowledge work and white-collar tasks

These innovations have helped Databricks surpass $4 billion in annualized revenue, growing 50% year over year, while becoming free-cash-flow positive—a rare milestone for a private company of its scale.

Its AI-specific revenue alone has exceeded $1 billion annualized, reflecting Databricks’ unique position at the intersection of data infrastructure and model development.

Competition with Snowflake intensifies

The ongoing rivalry between Databricks and Snowflake continues to shape the enterprise data landscape. Both companies now generate similar levels of revenue, but with key distinctions:

- Databricks leads on AI-native workloads, unifying data + model training within one platform

- Snowflake leads on cash flow generation and focuses heavily on cloud data warehousing

- Both companies compete for the same CIO budgets as enterprises increasingly standardize on a single platform for data + AI

Snowflake’s leadership has recently downplayed valuation comparisons, but the acceleration of Databricks’ AI initiatives suggests the competitive gap may evolve quickly.

Fuel for acquisitions, research, and expansion

If completed, the prospective capital raise would give Databricks additional flexibility to:

- Acquire AI-native startups and IP

- Hire top ML researchers and infrastructure engineers

- Expand its open-source ecosystem

- Deepen its investment into agents, retrieval, and real-time inference

The company has already completed several acquisitions over the past few years—including MosaicML, Okera, and Rubicon—to strengthen its AI stack.

Databricks now approaches 10,000 employees globally and remains one of the most anticipated private companies on the path to an eventual IPO. CEO Ali Ghodsi has repeatedly said he enjoys operating as a private company, though Databricks continues to run structured liquidity programs for employees and early investors.

A defining infrastructure player in the AI era

As AI adoption accelerates across every sector, Databricks’ unified approach to data, governance, and model development positions it as a critical pillar in enterprise transformation. Its trajectory—both in revenue and valuation—reflects a broader shift: organizations increasingly want a single, scalable platform to manage everything from raw data to production-grade AI agents.

In a market where the winners will likely define the next decade of enterprise software, Databricks remains one of the most strategically significant companies shaping how businesses build, deploy, and operationalize AI at scale.

Mercor’s Rise and Benchmark’s AI Shift

How a fast-growing AI labor platform is reshaping venture dynamics

Over the past year, Mercor has become one of the most closely watched companies in the AI economy—both for its explosive growth and for the way it has pushed even the most traditional venture capital firms to adapt. The company, led by co-founder and CEO Brendan Foody, sits at the intersection of human expertise and frontier AI model development. Its platform connects highly skilled professionals—doctors, lawyers, analysts, engineers—with leading AI labs and enterprises to “teach” advanced models through real-world judgment and domain-specific knowledge.

Mercor’s model reflects a fundamental shift in AI work: instead of humans repeatedly performing routine tasks, experts now codify workflows, evaluations, and reasoning patterns that help AI systems learn once and scale infinitely. As AI accelerates, Mercor’s network has grown into a critical part of the emerging “AI labor layer” powering next-generation agents and enterprise automation.

Benchmark’s renewed push into AI

This transformation has not gone unnoticed. According to several industry sources, Benchmark, one of Silicon Valley’s most iconic venture firms, made an unusually aggressive effort to back Mercor. The firm—which historically insists on ~20% ownership and a board seat—pursued Foody with a level of intensity rarely seen in today’s competitive venture market.

After weeks of discussions, Benchmark ultimately invested for a 10% stake at a $250M valuation, marking a notable shift away from its traditional ownership targets. The deal highlights the new reality: AI startups are raising larger rounds at higher valuations, and even elite firms must adapt.

Benchmark has largely stayed out of the largest foundation model companies, instead focusing on infrastructure and application layers where it has historically thrived. In recent years, the firm has backed companies such as Sierra, Fireworks AI, and Mercor, signaling a deliberate focus on AI workflows, inference infrastructure, and agent-driven enterprise software.

Mercor’s growth and new funding

This momentum culminated in Mercor’s announcement of its $350 million Series C, led by Felicis with participation from Benchmark, General Catalyst, and Robinhood Ventures. The round values Mercor at $10 billion, a five-fold increase from its Series B.

Mercor plans to use the capital to scale three core pillars:

- Expanding its global expert network across specialized domains

- Improving matching infrastructure between talent and AI training needs

- Accelerating delivery of high-quality evaluations, workflows, and reasoning datasets

The company’s position at the center of AI’s economic engine—where humans train and refine agents to perform increasingly sophisticated work—continues to strengthen with each new advancement in the field.

A new category of work

For millions of professionals, AI is reshaping the nature of skilled labor. Mercor’s platform reflects this shift:

- Doctors are helping models detect early medical signals humans may miss

- Bankers are teaching agents to perform financial analysis more efficiently

- Lawyers are refining model reasoning around precedent and legal judgment

As enterprises move from manual workflows to model-driven ones, the ability to encode human judgment into AI systems becomes an essential, scalable capability. Mercor is building the infrastructure for this emerging category of “expert-trained AI,” enabling people to move up the value chain as models automate more repetitive tasks.

Why this matters for the venture ecosystem

Mercor’s trajectory—and Benchmark’s pursuit—illustrate broader changes:

- AI startups are raising unprecedented amounts of capital

- Traditional ownership-targeting strategies are becoming harder to maintain

- Competition from tech giants and multi-billion-dollar AI funds is intensifying

- The most valuable startups may now emerge from new labor-AI hybrid categories

For Benchmark, adapting its investment model reflects a strategic shift in a market where speed, flexibility, and conviction increasingly determine outcomes.

For Mercor, it underscores the company’s role as a defining force in how human and artificial intelligence interact to create economic value.

Three Eastlink Portfolio Companies Were Recognized in The 2025 Enterprise Tech 30 List for the Third Consecutive Year

We’re proud to see our 3 portfolio companies, Modal, MotherDuck, and Databricks earn top rankings on Wing Venture Capital’s Enterprise Tech 30 list for the 3rd year in a row! This recognition highlights the impact and innovation these companies are driving in enterprise technology.

Modal (#2 in Early Stage) – Modal is an IAS platform that allows users to deploy LLMs and run inferences in the cloud with only a few lines of code.

MotherDuck (#9 in Mid Stage) – Revolutionizing the data analytics landscape, MotherDuck combines the power of DuckDB with the cloud for lightning-fast, cost-efficient data processing.

Databricks (#1 in Giga Stage) – Databricks is the pioneer of the Data Intelligence Platform, empowering enterprises to unify, analyze, and leverage their data for transformative insights.

Congratulations to our portfolio companies for the three-peat! We’re proud to support their journeys and can’t wait to see what’s next.

Check out the full list here: Wing Venture Capital Enterprise Tech Top 30

Eastlink Capital’s Latest Investments and Milestones: Benchflow, Seraphic, Sensely AI, and Genmo

Eastlink Capital’s Fund Updates: Fueling Innovation Across AI

At Eastlink Capital, we remain committed to supporting transformative startups across AI Infrastructure and application. As we step further into 2025, we’re excited to share some of our latest investment and portfolio updates from 2024, highlighting key funding rounds and acquisitions that mark significant milestones for our partners.

Genmo – Series A Investment (2024)

Genmo is a text-to-video generation platform with an open-source state-of-the-art model that has high-fidelity motion and strong prompt adherence. In 2024, Eastlink Capital invested in Genmo’s Series A round, fueling its mission to push the boundaries of AI video generation.

BenchFlow – Pre-Seed Investment (December 2024)

BenchFlow is a cloud-native AI agent benchmarking and evaluation platform that simplifies AI model evaluation workflows and creates a marketplace for benchmark and evaluators. In December 2024, Eastlink Capital Co-led BenchFlow’s pre-seed round, backing its vision to redefine enterprise efficiency with next-gen automation tools.

Seraphic Security – Series A Investment (December 2024)

Seraphic is a complete enterprise browser security and governance solution designed to monitor and audit the browser by using a proxy or extension. In December 2024, Eastlink Capital doubled down on Seraphic’s Series A round, supporting the company’s rapid growth and strengthening the global enterprise browser security.

Sensely – Acquired by Mediktor (2024)

Sensely, a leader in AI-powered virtual health assistants, was acquired by Mediktor in 2024. Sensely’s technology, which enhances patient engagement through conversational AI, will now be integrated into Mediktor’s telehealth solutions, marking a strategic move in advancing AI-driven healthcare services.

As we continue to back pioneering startups, we’re thrilled to see our portfolio companies making strides in their respective industries. Stay tuned for more updates as we work alongside visionary entrepreneurs shaping the future of AI, cybersecurity, cloud automation, and digital health.

— Eastlink Capital Team

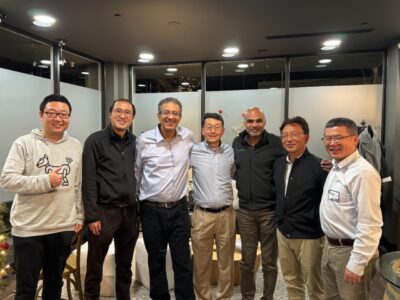

2024 Annual Event

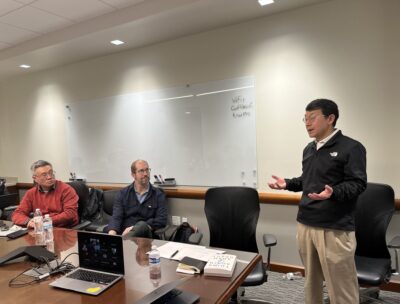

We were thrilled to host the Eastlink Capital 2024 Annual Meeting on January 17, 2025, marking a decade of innovation, partnerships, and growth. Celebrating our 10th anniversary, we gathered with our LPs, portfolio founders, and industry leaders who have been instrumental in shaping our journey.

Our partners Steven Xi and Eric Ye shared the exciting momentum of our fund, reaffirming our commitment to AI infrastructure and the next wave of technological breakthroughs.

The event featured thought-provoking discussions, including a fireside chat with Francisco Alvarez-Demalde from Riverwood Capital and an inspiring conversation between Ion Stoica, Co-Founder & Executive Chairman of Databricks, and Steven Xi. Our AI infrastructure panel brought together top minds—Kai Li (Princeton University), Yiran Chen (Duke University), and Jamin Ball (Altimeter Capital)—for deep insights into the evolving landscape.

We were also proud to showcase groundbreaking work from our portfolio companies:

– Jordan Tigani, CEO, MotherDuck

– Kamal Gupta, CEO, Omnistrate

– Erik Bernhardsson, CEO, Modal

– Suresh Batchu, COO, Seraphic Security

– Rajeev Shrivastava, CEO, TigerGraph

A heartfelt thank you to our LPs, founders, panelists, and advisors—your trust and support fuel our vision every day. Here’s to another decade of innovation and success!

Onwards and upwards!

Doubling Down on Seraphic Security: Our Continued Bet on the Future of Browser Security

At Eastlink Capital, we believe in backing bold founders tackling critical cybersecurity challenges—and Seraphic Security is leading the charge in enterprise browser security. We’re thrilled to double down on our investment in Seraphic by participating in their $29M Series A round, led by GreatPoint Ventures, alongside CrowdStrike Falcon Fund, Planven, Cota Capital, and Storm Ventures.

In today’s SaaS-first, hybrid work environment, securing the enterprise browser is more important than ever. Seraphic Security is redefining how organizations protect their most critical access points, delivering cutting-edge security without compromising user experience. With this new funding, Seraphic is poised to scale operations in North America and EMEA while continuing to push the boundaries of innovation.

We couldn’t be more excited to support Seraphic’s visionary founders and world-class team as they build the future of enterprise browser security.

2023 Annual Event

We had an unforgettable celebration of 2023 with founders, LPs and friends at our annual meeting and dinner.

Our fireside chats featured insights from partners at Prosperity7 and Felicis on the ever-evolving AI world and strategies to build defensible moats; next up were awe-inspiring presentations and demos from MotherDuck, Modal Labs, TigerGraph and Vellum.

Happy holidays and look forward to seeing you in the next year. Onwards and upwards!

Modal Lab’s Series A and GA Launch

We are privileged to be a part of Modal’s Series A round to redefine the future of end-to-end cloud compute, providing serverless GPU to deploy AI models and run inference in the cloud with a few lines of code, without the complexities of setting up and maintaining your own cloud infra.

Modal Labs has launched its General Availability version. Everyone can try it out and run code in the cloud in a few minutes. Check it out today and you will be surprised how frictionless, scalable and cost-efficient it is!

Databricks’ Series I

Congrats to the Databricks team for the $500M Series I! We are so thrilled to double down our investment through its round, as an existing investor and faithful believer. We believe Databricks is incredibly positioned to be a generational company in the AI era, due to its robust tech/product, rapid pace of innovation, open-source root and vibrant ecosystem. Cannot wait to see what’s ahead for Databricks as it continues the journey of democratizing AI and Data through relentless innovation.

See more: press release on Forbes